POSTS ARCHIVE: UNCATEGORIZED

Mark your calendars: 10 must-do events in September

Never miss an event with some help from Uber Use promo code CLTAgenda17 for $20 off your first ride. Here are the events you can’t miss this September – chronologically, so you can hit them all. See you out there, and don’t forget to show us what you’re doing via #cltagenda.

City skyline

Photo By: John Doe

Button

4 cities where growth is increasing rental demand and rents

Rental growth has a lot to say about supply and demand in the rental apartment market. Over the past several years, we saw rents move up at above average levels nationwide. We are now seeing many markets losing some steam. They are catching their breath, allowing demand to catch up a bit with an impressive…

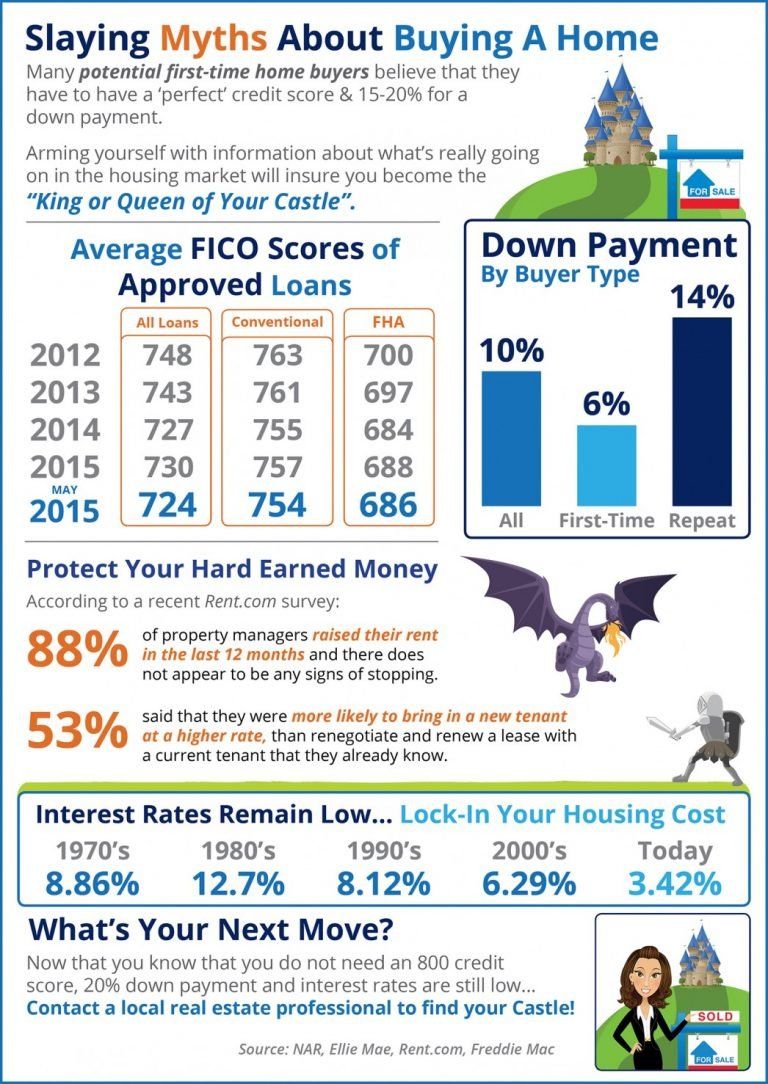

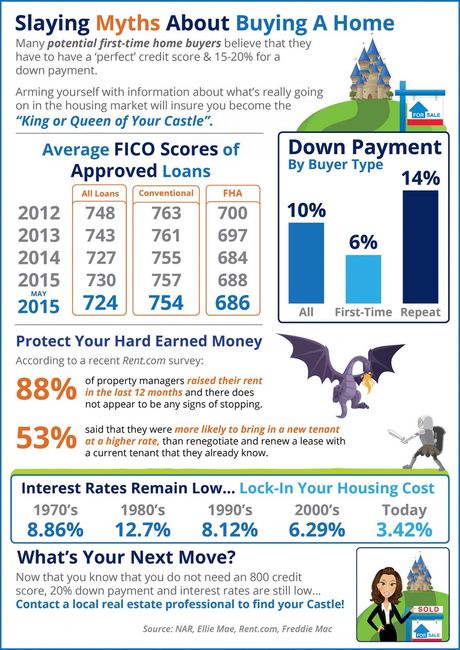

Slaying Home Buying Myths

Some Highlights: Interest rates are still below historic numbers. 88% of property managers raised their rent in the last 12 months! The credit score requirements for mortgage approval continue to fall.

City skyline

Photo By: John Doe

Button

Here’s where Zillow ranks Charlotte among U.S. cities where people want to live — or leave

Washington, D.C., Miami, Detroit, Houston and Chicago want out – and not many house-hunters want in. Meanwhile, Seattle, Tampa and Portland are popular targets for homebuyers who live elsewhere as well as residents who already live in those cities. As for the Queen City, residents want out while outsiders want in.

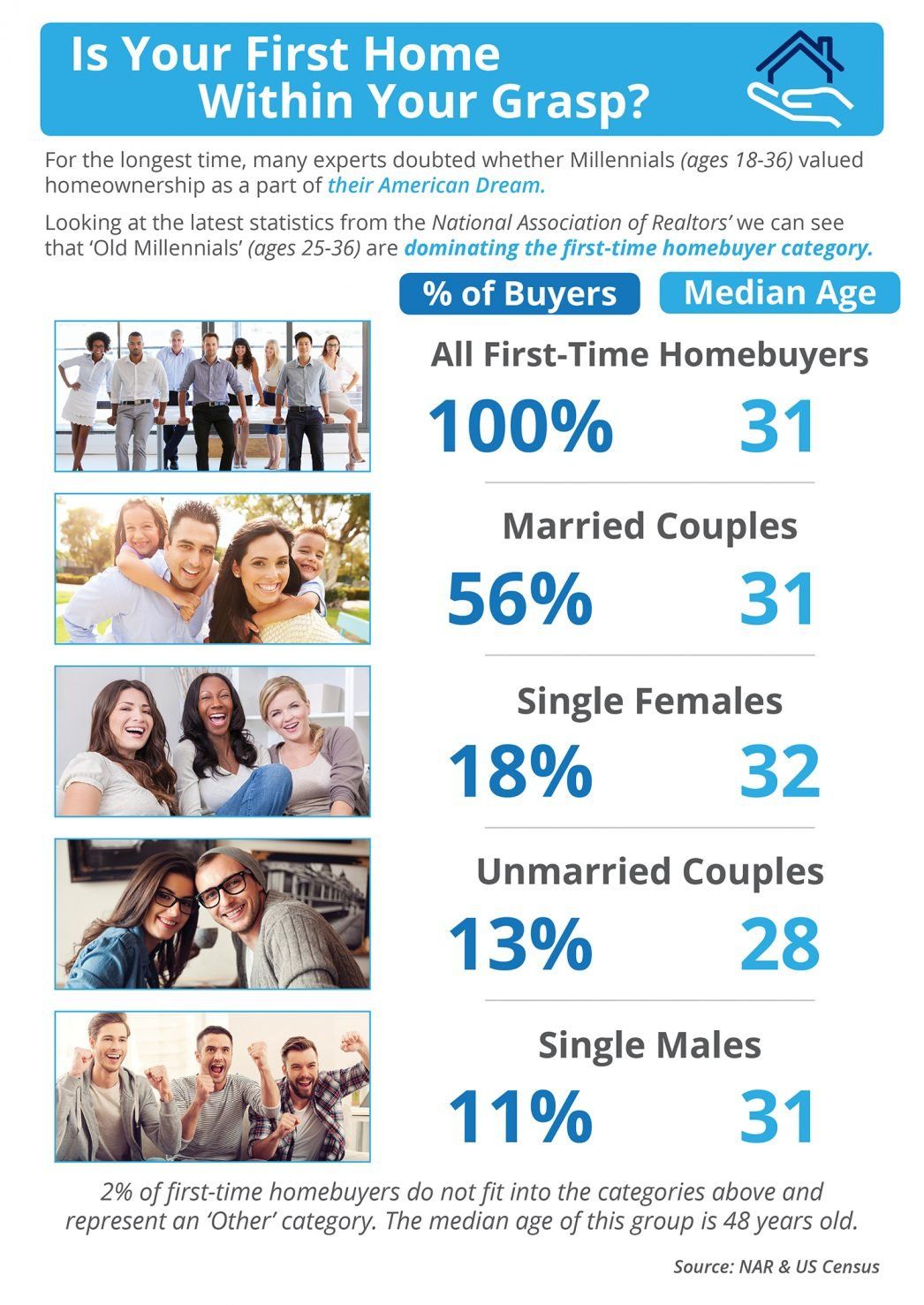

Is Your First Home Within Your Grasp?

Some Highlights: ‘Millennials’ are defined as 18-36 year olds according to the US Census Bureau. According to NAR’s latest Profile of Home Buyers & Sellers, the median age of all first-time home buyers is 31 years old. More and more ‘Old Millennials’ (25-36 year olds) are realizing th

City skyline

Photo By: John Doe

Button

Home Mortgages: Rates Up, Requirements Easing

City skyline

Photo By: John Doe

Button

Hispanic Family Moving Into New Home

The media has extensively covered the rise in mortgage interest rates since last fall (from 3.42% last September to the current 4.1% according to Freddie Mac). However, a less covered aspect of the mortgage market is that requirements to get a mortgage have eased while rates have risen. The Mortg

Our New Blog!

Check back soon for industry-related news and information about upcoming events in the area!